Keeping up-to-date records of your business finances is a definite indicator of growth and better decision-making. That’s the reason why most enterprises prioritize financial data analytics to boost their business health.

As per a U.S. Research Report, the market size of the financial data service industry in the US was 19.82 bn in 2022. Furthermore, it’s also projected that revenue share will increase by 2.1% to reach 23.7% by the end of 2023.

Interestingly, more than half of the users investing in analytics are either from companies or professionals in finance and trading. Beyond any doubt, we can say that there will be a sharp increase in the demand for big data analytics and insights in the global economy, particularly the finance sector.

With market changes and tech advancements, companies devise a future-proof strategy to cope with the existing and forthcoming challenges. From this perspective, investing in data analytics in banking and financial institutions makes sense.

How, you ask?

Go through this blog till the end and find out for yourself how financial analytics can boost your business growth.

Table of Contents:

What is Financial Data Analytics?

The basic definition of financial analytics outlines implementing a range of practices to assess & examine a company’s financial health.

It involves a series of techniques to collect, visualize, and analyze past and present data of an organization to determine its overall efficiency & performance.

Finance and data analytics come together to deliver quality data insights and actionable reports. They’re further used by enterprises to mitigate risks and make confident business decisions.

Optimizing your business data for financial process management is a critical strategy for both small & big enterprises. In this context, the role of business intelligence and data analytics comes in for these purposes:

-

For financial planning and future predictions to prepare for frequent market changes and needs.

-

For getting detailed insights and records into the financial areas of the organization. It guides finance managers in analyzing financial visibility, revenue areas, net income, expenses, resources, etc.

-

For storing data-defined inputs in one place and getting granular-level views to analyze them for financial planning.

-

For measuring and managing assets such as cash and resources for productive financial management and accounting efforts.

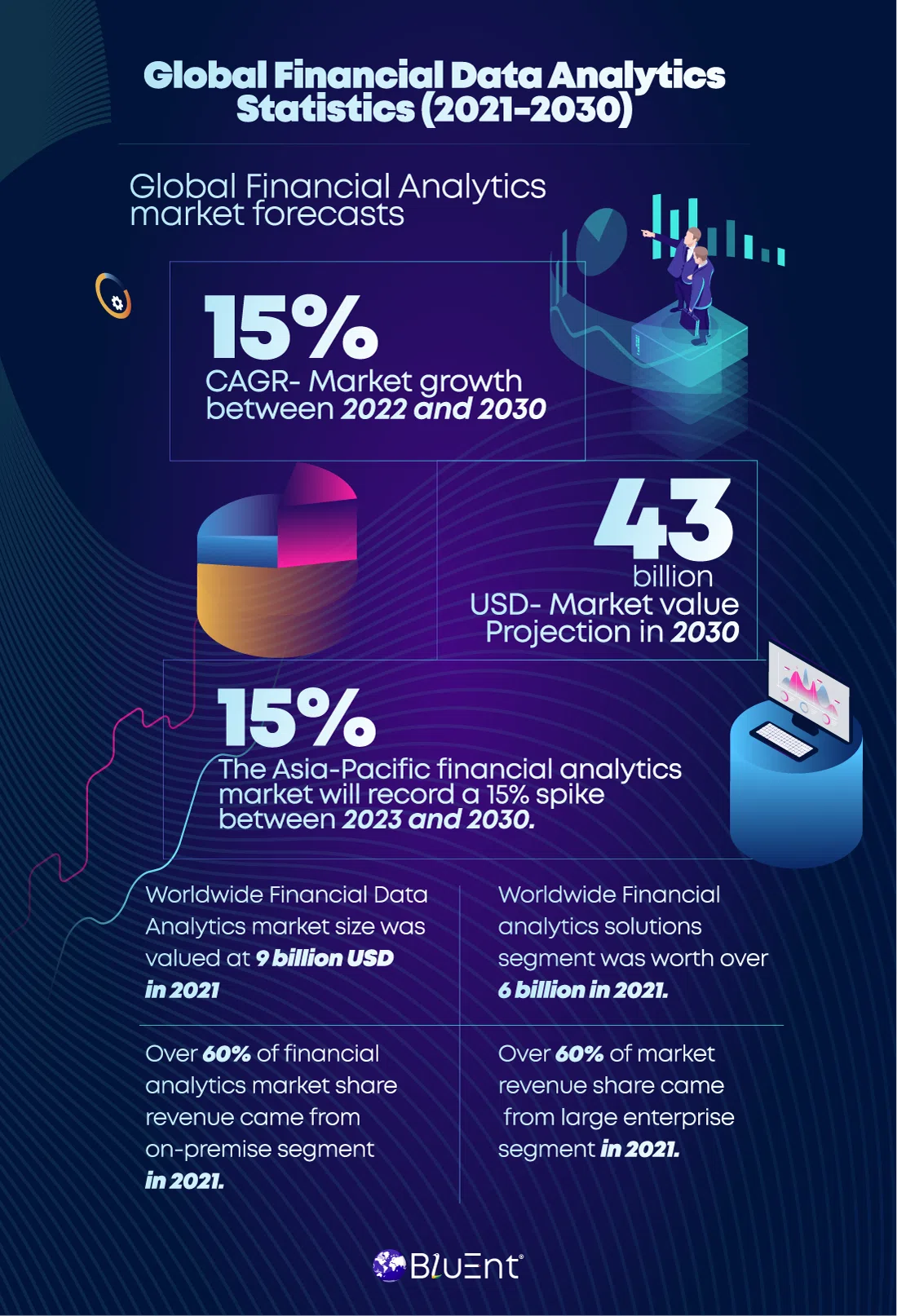

Considering these key pointers, any business entity shall be interested to implement the future trends of big data analytics in finance. Let’s catch some impressive facts and figures on the finance and analytics market.

Quick Stats on Financial Data Analytics

Financial analytics is an integral part of business growth strategy and success. From detailed reports to informative visualizations, it involves different ways to modernize your business intelligence results to the next level.

If you’re still unsure about the benefits of financial analysis, then these statistics may change your mind!

-

Nearly 63% of companies are using data analytics for improved efficiency and productivity.

-

The market size of Data Analytics Financial Service Providers in the US grew faster than the overall economy.

Inspired enough? Continue reading the next section and know how the benefits of financial analysis help a business like yours.

Recommended Reading:

Top Reasons to Opt for Data Analysis in Finance

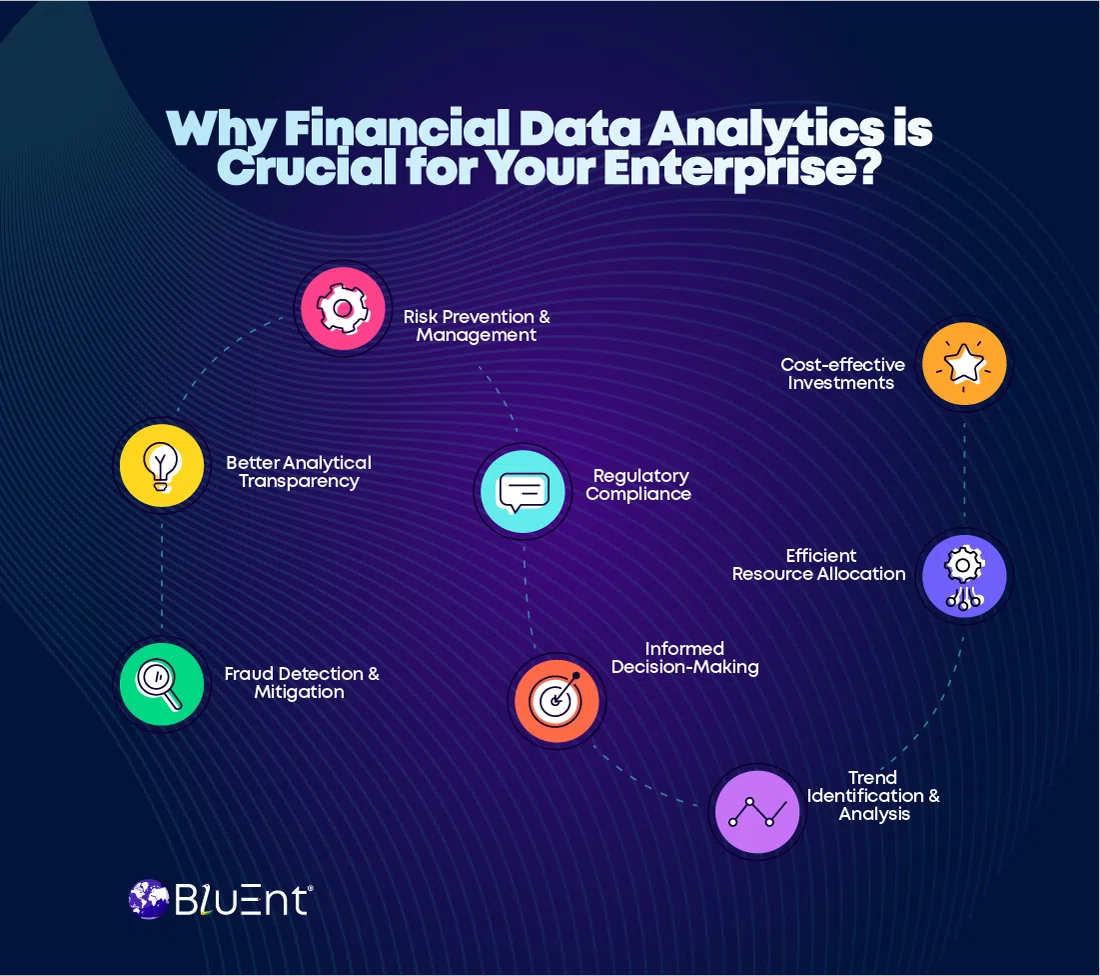

We already know that data analytics aims to apply financial statistics techniques to data so that enterprises can identify trends and solve problems. The role of financial data analytics revolves around similar objectives of dealing with market risks and uncertainties.

With the introduction of big data in finance, many industries including Fintech, trading, insurance, banking, and investment can future-proof their strategies against upcoming challenges. There are several financial data analytics available in the market.

Let’s give you more reasons to consider financial data analytics as a part of your strategic business plan.

Faster & Informed Decision-Making

Strategic planning is imperative to making the right business decisions. Whether you’re a new entrant or existing for years, you may need insightful data to devise your plans.

The methodology of data analytics in finance makes it possible to fetch valuable insights and utilize them in your company’s favor. This advantage of business automation with financial data analytics empowers strategists to observe reliable insights in the form of tables, graphs, charts, & other visualizations.

Enterprises investing in financial analytics services can evaluate their spending, product or service pricing, end results, profitability, and other parameters of business performance. It enables them to sort out the plans that are generating profits & refine those that are not working.

Risk Prevention & Management

The demand for project risk management is one of the key growth drivers of the finance and data analytics industry. After all, it remains a major concern for almost every growing business.

Financial analytics give ample options to help you foresee potential risks and prepare to mitigate them in advance.

Let’s say an insurance company recommends the best-suited policy plan to customers based on their age, interests, preferences, and other relevant data. As a result of financial data analytics, they use predictive maintenance for risk management and take relevant actions against the possibility of customer dissatisfaction.

Cost-effective Investments

Balancing between cost and quality is one of the biggest challenges of any enterprise with budget limits. In such cases, finance and data analytics come together to encourage cost savings and boost revenue rates.

Industries depend on data analytics financial services to track the profitability of their expenses and check if they’re worth it or not. Therefore, they can improve efficiency and cut costs.

For instance, logistics can implement financial analytics for supply chain management and reduce the overall cost of their daily operations.

There will be minimum expenses on fuel, resources, and repairs once you start investing in more efficient equipment and narrowing down the delivery process based on an analytical approach. This implies the need for supply chain localization as well.

Discover how we implemented advanced financial analytics to leading enterprises.

Trend Identification and Analysis

One more benefit of financial analysis is an effortless analysis of your brand positioning and trends associated with it. Businesses can study the trends, financial status, and factors impacting overall growth over time.

There are different types of data analytics techniques for enterprises intending to study their financial strength. For example, retail merchants keep an eye on industry trends & customer interests to strategize accordingly.

They leverage big data in sales and marketing to understand what people like and what they don’t. Financial data analytics gives detailed insights into the best-selling products, pricing changes, & demand peaks during seasonal sales.

The advantage of data analytics in finance is not limited to the retail sector. Manufacturers, logistics, healthcare, and supply chain industries are also reliant on it for identifying and analyzing trends.

Fraud Detection and Mitigation

Financial analytics also help in active fraud detection and prevention. Organizations keeping tons of confidential info in a data warehouse can use advanced data insights into suspicious transactions & identify them.

Any fraudulent activity including huge transactions and unauthorized access can be avoided with analytical insights. No doubt, it’s a powerful enterprise data management tool that also safeguards your business from bearing huge financial losses.

Better Analytical Transparency

Data analytics gives access to a company’s financial assets, resources, and expenses. This is advantageous for predictive cash flow forecasting, budgeting, and better allocation of resources.

For example, the way data analytics in manufacturing improves production processes and efficiency, financial data analytics helps in meeting the demands and avoiding shortages.

Efficient Resource Allocation

Facing issues with your business resources? You may not be allocating them in the right way.

The benefits of financial analysis may be more promising than your existing resource allocation techniques. This will help you determine ways to cut costs and augment your profitability. However, you must hire expert financial data analytics service providers to proceed with this approach.

Regulatory Compliance

Adhering to standard regulatory compliance is crucial for your business’s success. The advantage of financial analysis allows companies to identify loopholes in the regulatory system and take actions to dissolve them.

How Can BluEnt Help in Finance and Data Analytics?

Both business automation and advanced analytics have revolutionized the way organizations streamline their internal operations & reduce costs. With sought-after applications in the finance industry, the role of data implementation and analytics is more than important for a business aiming to optimize budgets at lower risks.

At BluEnt, our expertness in being one of the top-notch financial data analytics companies defines years of excellence & global presence.

We help clients from finance, healthcare, retail, legal, gaming, and other industry domains refine their business goals with data-driven insights and result-driven decisions. Our key service offerings include big data management, big data analytics and insights, big data implementation, and predictive analytics.

Want to optimize your finances more efficiently? Get expert data analysts at BluEnt!

Don’t forget to explore our portfolio to learn what exactly we do.

Frequently Asked Questions

What are the best data analytics tools and technologies to use?

Most data analytics companies prefer using these tools and software for finance projects:

-

FactSet Portfolio and Risk Analytics

-

Asset-Map

-

eMoney

-

RightCapital

-

Brisk for risk monitoring

-

Neudata

What are the challenges of financial data analytics?

Enterprises face three common challenges while implementing financial data analytics in a business & here are they:

-

Data silos cause issues with data kept across different spaces, including systems, databases, apps, etc.

-

Some issues may also arise while analyzing semi-structured data.

-

Inappropriate governance can cause inaccuracy in data insights.

How Financial and Accounting Services by BluEnt Drive Business Growth in the Digital Era?

How Financial and Accounting Services by BluEnt Drive Business Growth in the Digital Era?  Secure Gift Cards: Top Tips and Strategies’ to Safeguard Personal Information

Secure Gift Cards: Top Tips and Strategies’ to Safeguard Personal Information  Cloud Data Engineering: Infrastructure and the Road Ahead

Cloud Data Engineering: Infrastructure and the Road Ahead  Real Time Analytics: Facets, Insights, and Use Cases

Real Time Analytics: Facets, Insights, and Use Cases