Fraud data analytics is one of the most sought-after practices for detecting and controlling unethical methods of acquiring sensitive data. The rising cases of financial fraud and data breaches indicate why businesses are keen to invest in big data analytics for fraud analysis and prevention.

According to a study, over 422 million Americans were impacted by compromised data in 2022. Moreover, credit card fraud accounted for more than 43.7% of identity thefts during the year.

With advancing technology and digital innovations, escaping the risks of fraud and financial loss has become challenging yet achievable. Companies using high-tech IT infrastructure and automated machinery are poised to adopt data analytics and shape a reliable anti-fraud strategy.

From startups to big organizations, fraud analysis contributes to risk prevention and management at every operational level.

If you’re new to fraud analytics, you might want to get more details on how it can benefit your business. Read on.

Table of Contents:

What is Fraud Data Analytics?

Let’s start by defining what fraud analytics is.

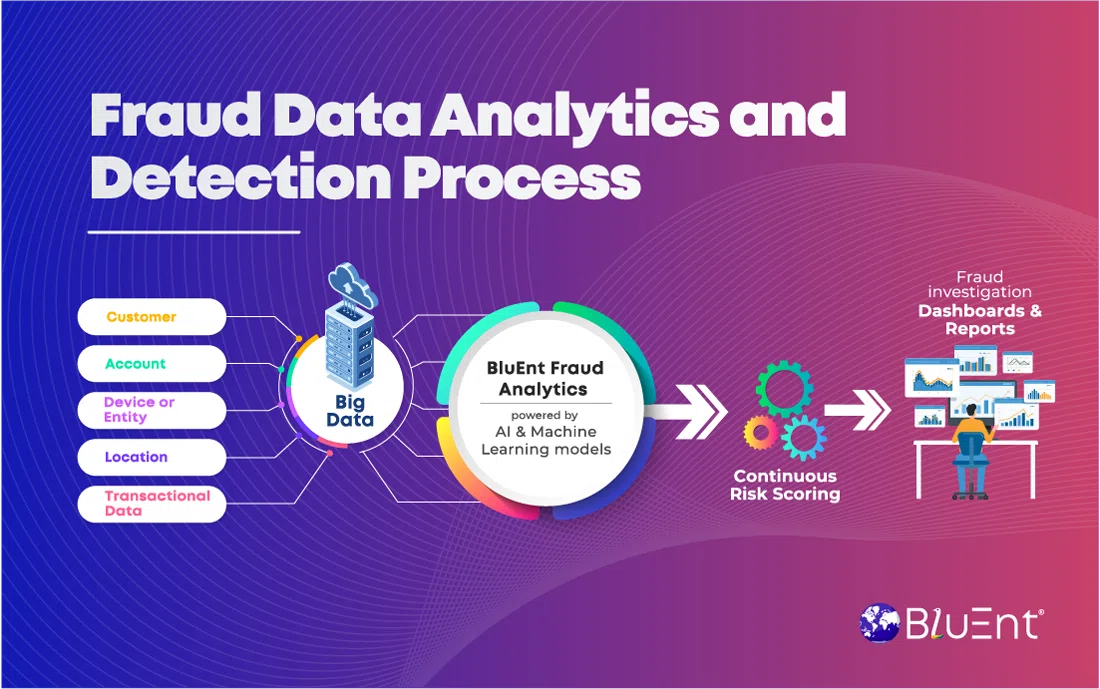

Fraud data analytics is a method or technique that uses big data to detect and prevent financial fraud or risks. It helps in predicting future risks and fraudulent behavior.

Using data analytics for fraud management, companies can track suspicious activities using machine learning models and data mining. As a result, it benefits them with fast fraud detection and mitigation in real-time.

Every business entity, whether small or large, must prioritize fraud detection analytics to:

-

Switch from manual and tedious procedures to data-driven methods of detecting scams within external and in-house operations.

-

Examine large datasets and spot high-risk trends, anomalies, and patterns indicating potential online frauds related to credit card transactions, purchasing processes, account activities, etc.

-

Reduce costs of bearing fraud-related losses and improve business results.

-

Run effective fraud and financial risk analytics programs to identify unwanted risks or fraudulent activities at an early stage.

-

Strengthen organizational controls and find resources vulnerable to risk.

Why is Fraud Analytics Important for Your Business?

Proactive data monitoring can reduce financial loss by 54% and can cut fraud detection time by half. Organizations are no longer reliant on manual techniques of internal auditing and employee security compliance, thanks to data analytics and its types.

While the world is turning towards online payments, shopping, trading, and banking modes, people are prone to online fraud and threats. Whether it’s about stealing card credentials or cloning credit card information, scammers have found newer ways to commit online fraud.

The advantage of data-driven risk analysis management is that it enables companies to analyze data that will be used to predict, detect, and plan against fraud.

Let’s review why fraud analytics is vital for your business.

Detect Hidden Patterns

One primary benefit of fraud risk analytics is the early detection of underlying issues, trends, and patterns that may lead to severe financial fraud.

It uses advanced big data analytics trends to track unusual patterns, which traditional methods fail to do.

Smooth Data Integration

Risk and fraud analytics need big data implementation for seamless data integration. It extracts data from various sources and public sources to combine into a model.

Added Value to Ongoing Efforts

Fraud data analytics synchronizes with your existing efforts and adds value to the results. That will let you analyze what works for your business and what won’t.

Moreover, the advantage of predictive analytics for risk management and fraud detection will enable you to determine other areas of improvement. That will eventually help you shape a robust anti-risk strategy.

Reviewing Unstructured Data

Unstructured data is not easy to manage. However, it’s a place where most fraud and scams happen.

Financial crime data analytics allows for the reviewing of structured and unstructured data stored in data warehouses and the prevention of fraudulent activities.

Get insights into how data analytics is empowering top brands and growing enterprises.

Best Techniques to Perform Fraud Detection Analytics

Using data analysis to detect credit card fraud and other online scams is a prominent strategy to avoid significant financial loss. But how are businesses implementing the same?

Companies wanting to leverage fraud analytics solutions can try these techniques.

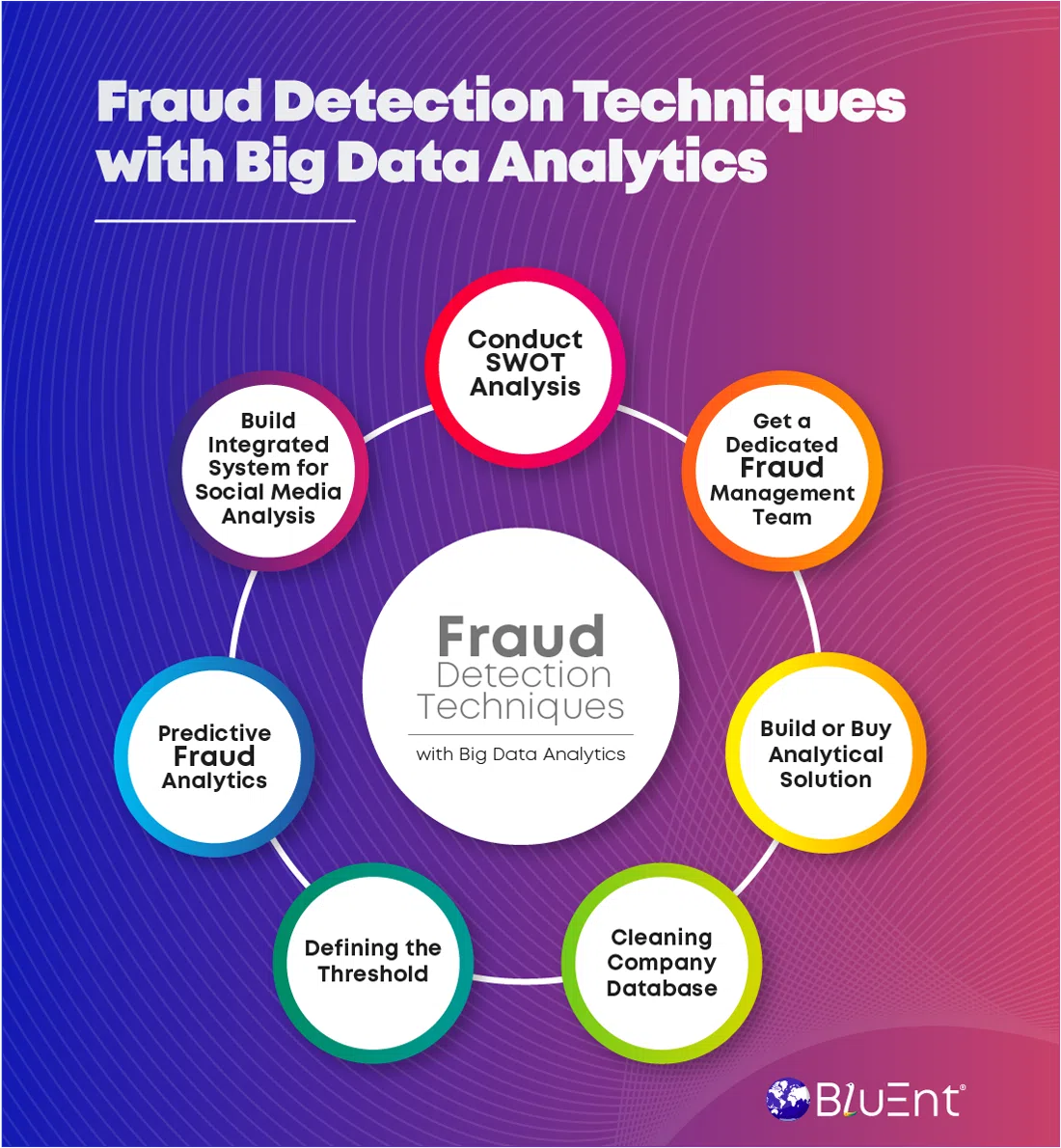

Conduct SWOT Analysis

Doing some groundwork before deploying any fraud analytics tool or software is essential. Many companies must consider their strengths and weaknesses and spend more than the estimated budget.

Hence, it’s advisable first to analyze your business Strengths, Weaknesses, Opportunities, and Threats to make the right decisions.

Get a Dedicated Fraud Management Team

Not all organizations are competent to use data analytics for fraud detection on their own. They may need to hire dedicated fraud analysts and get a reliable anti-fraud strategy using data.

Getting a team helps in the efficient management and prevention of online fraud.

Build or Buy Analytical Solution

Upon doing SWOT analysis and hiring data experts, the next step is to know whether you want to develop an anti-fraud solution on your own or approach vendors for the same.

You must finalize the resources and other investments for the fraud detection analytics program at this stage. If you realize the need to get fraud analytics software developed by a third-party service provider, then you must:

-

Do research work to find a credible company,

-

Define your budget before reaching out to any vendor,

-

Know what you need and what you expect from the investment,

-

Discuss the features, technologies, user experience, and other required add-ons to a fraud management system.

Refine Company Database

This data analysis technique for fraud detection involves aggregating company databases and cleaning them up individually.

However, organizations keeping large amounts of data can use big data management tools to do it quickly.

Defining the Threshold

A fraud detection system will not be of any use if its threshold boundaries are not set in the right way.

You may need experts to set boundary values to detect each trend or anomaly on the software. If the boundary values are too high, the software will likely miss out on pinpoint indications of fraud and threats. Whereas setting low boundary values can waste a lot of time and resources.

So, make the right decision while defining the threshold value of your fraud detection system.

Predictive Fraud Analytics

Data mining and predictive analytics come together to generate fraud propensity scores for uncertain metrics.

It automates the scoring process and shares results for further analysis.

Build an Integrated System for Social Media Analysis

Another solid way to use data analytics for fraud detection is social media analysis.

No wonder social media apps and networks connect users who can be suspected scammers and hackers. Companies can collect related data from social networks such as IP addresses, contact numbers, emails, and other info to reach online fraudsters.

Recommended Reading:

How Can Fraud Analytics at BluEnt Protect Your Business from Vulnerable Risks?

Adopting fraud analytics in banking, insurance, and other financial corporations is relevant to rising cases of cybercrimes and online threats. It’s a more critical strategy to protect your business and customers from heavy financial losses.

Companies planning to start a fraud detection program can take small steps to see the results. At BluEnt, we have a team of certified data scientists to help you in diverse areas of enterprise data management.

Our global presence in 7+ countries and our clientele of who’s who in business demonstrate our superiority in business consulting, architectural engineering, and managed IT services.

BluEnt’s service offerings include business intelligence, enterprise data management, Customer Relationship Management, Business process management, and enterprise content management. Explore our portfolio to check out our latest ongoing projects.

Get started with fraud analytics for strategic risk prevention. Contact us!

Frequently Asked Questions

What are the best fraud analytics tools to try?

-

Kount, an enterprise-grade fraud detection tool.

-

Signifyd an automated fraud prevention software for merchants.

-

ArkOwl, a live data refinement tool for multiple sources.

-

FraudHunt is cost-effective security software for growing markets.

What are the significant features of fraud data analytics software?

Here are the key features of an enterprise-grade fraud data analytics system:

-

Risk rules filter out user activities that can cause fraud.

-

Risk scoring to allow or reject user actions.

-

Real-time monitoring to avoid money laundering cases.

-

Machine learning engine to analyze historical patterns and predict frauds.

Snowflake Cortex Agents: Scalable AI for Enterprise Data Insights

Snowflake Cortex Agents: Scalable AI for Enterprise Data Insights  Informatica ETL vs Informatica MDM: Which One Does Your Business Need?

Informatica ETL vs Informatica MDM: Which One Does Your Business Need?  How Financial and Accounting Services by BluEnt Drive Business Growth in the Digital Era?

How Financial and Accounting Services by BluEnt Drive Business Growth in the Digital Era?  Secure Gift Cards: Top Tips and Strategies’ to Safeguard Personal Information

Secure Gift Cards: Top Tips and Strategies’ to Safeguard Personal Information